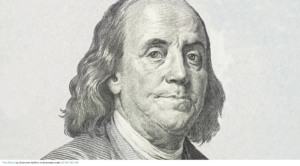

Well, it’s that time of the year again that many of us dread … filing our state and federal tax returns. As attested to by one of our founding fathers, Benjamin Franklin, over 235 years ago in 1789, nothing is more certain in our lives:

“Our new Constitution is now established and has an appearance promising permanency. But nothing can be said to be certain in this world except death and taxes.”

However, the taxes Franklin was referring to were not income taxes. They were mostly sales taxes by the British and our government on goods being bought and sold here.

The history of income taxes in the United States is remarkable in that it is so recent. It was only 150 years ago (1862) that President Lincoln signed into law a revenue-raising measure to help pay Civil War expenses, creating a Commissioner of Internal Revenue and the nation’s first income tax. It levied a 3 percent tax on incomes between $600 and $10,000 and a 5 percent tax on incomes of more than $10,000. The income level threshold was an enormous amount of money back then so most paid little to nothing in taxes.

It may be surprising given how small this tax appears to us today, but there were terrible reactions to this new tax. By 1867, just five years after it was introduced, public opposition was so fierce that Congress cut the tax rate, and in 1872, the income tax was repealed. From 1868 to 1913, 90 percent of all tax revenue came from taxes on liquor, beer, wine and tobacco. Today, we would call these sin taxes. A few years later, prohibition killed that golden goose.

In 1894, the Wilson Tariff Act revived the income tax and an income tax division within the Bureau of Internal Revenue was created, but a year later, in 1895 the Supreme Court ruled the new income tax unconstitutional on the grounds that it was a direct tax and not apportioned among the states based on population. The income tax division was disbanded. So, what started in 1862 ended in 1895.

Then in 1909, just over 100 years ago, President Taft recommended Congress propose a constitutional amendment that would give the government the power to tax incomes without apportioning the burden among the states in line with population. Congress also levied a 1 percent tax on net corporate incomes of more than $5,000.

The arguments for and against taxes have provided full employment for accountants and lawyers. Just ask any accountant these days how complex the tax code is. Do you remember Herman Cain’s 2012 campaign called the 9–9–9 Plan? It called for the replacement of all current taxes, such as the payroll tax, capital gains tax, and the estate tax, with a 9% personal income tax, 9% federal sales tax, and a 9% corporate tax.

So, based upon this very quick review of tax history, I would hope you agree that taxes are far from certain. Being taxed is certain … we just aren’t sure how much and how it will be extracted. Each year most of us rely on professionals to tell us what this all means and what we must do to comply.

So, eat, drink and be merry! And enjoy one politician’s explanation of his position on alcohol. This funny and true story is from Armon Sweat, Jr., a member of the Texas House of Representatives. In 1952, Armon was asked at a campaign rally about his position on whiskey, which was a contentious campaign issue. From the Political Archives of Texas, what follows is his answer to the question about his stance on alcohol:

“If when you say whiskey, you mean the devil’s brew, the poisonous scourge, the bloody monster that defiles innocence, dethrones reason, and takes bread from the mouths of little children. If you mean that evil drink that topples Christian men and women from the pinnacles of righteous and gracious living into the bottomless pit of degradation, shame, despair, helplessness, and hopelessness. Then, my friend, I am opposed to it with every fiber of my being.

However…. if when you say whiskey you mean that oil of conversation, that philosophic wine consumed when good people get together, that puts a song in their hearts and the glow of contentment in their eyes; if you mean the drink that puts a spring in the step of an elderly man on a frosty morning; or that enables man, if for a moment to forget life’s great tragedies, heartbreaks and sorrow; if you mean that nectar of the gods through the sale of which pours untold millions of dollars each year into our treasuries, providing tender care for crippled children, the infirmed, and builds highways, hospitals, and colleges in this nation. Then my friend, I am absolutely, unequivocally in favor of it.

This is my position, and as always, I refuse to compromise on matters of principle.”