I have long wondered whether the dominant use of chemotherapy we all hear about and experience is really all that good for our health? According to many health professionals I talk to … some is and most is not. However, it is all good business for those who provide it … that is when you define good business as making profits.

Interestingly, MIT Research is now concerned about the health care research business. Here is their excerpt:

“There has been a trend toward lowering the bar for new medicines, and it is becoming easier for people to access treatments that might not help them—and could even harm them. Anecdotes appear to be overpowering evidence in decisions on drug approval. As a result, we’re ending up with some drugs that don’t work.”

“We urgently need to question how these decisions are made. Who should have access to experimental therapies? And who should get to decide? Such questions are especially pressing considering how quickly biotechnology is advancing. We’re not just improving on existing classes of treatments—we’re creating entirely new ones.”

For many, especially those with severe diseases, an experimental treatment may be better than nothing. But if companies struggle to get funding following a bad outcome, it can delay progress in an entire research field.

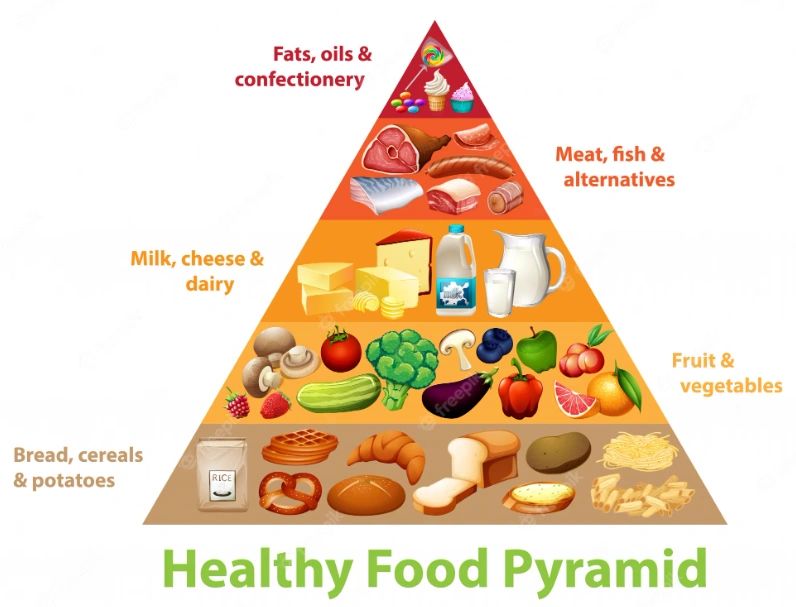

A key part of our health is of course what we eat. We are all told to eat fresh vegetables and to avoid salt, yet our food companies push us toward prepared foods and salty snacks with low to no nutritional value. They also push bottled water which pollutes the planet.

Many of us donate our time and resources to local food banks, and tend to emphasize good food choices … well, perhaps a bit heavy on the carbs, but let’s let that go. When I see an article pleading with us to help those with food insecurity I have to wonder. Here is our government’s latest initiative: FACT SHEET: Biden-Harris Administration Launches the White House Challenge to End Hunger and Build Healthy Communities, Announces New Public & Private Sector Actions to Continue Momentum from Historic Hunger, Nutrition, and Health Conference | The White House

Please square this with the following summary statement from the energy efficiency and green choice advocacy group greenbiz.com recently:

“It’s a sad truth that at least 10 percent of American households are experiencing food insecurity. At the same time, diet-related diseases including type-2 diabetes, obesity and hypertension are increasing. These are preventable problems that have been manufactured, in part, by big food companies. But now is the time for the private sector to step up.”

So, big food companies are deliberately deteriorating our health because they make more money doing that. I don’t see any warnings on the packaging about limiting our daily consumption or how to eat a balanced diet. Meanwhile our government is banning natural gas in stoves, water heaters, and space heating in new construction, and banning internal combustion engines. These alternatives all raise our costs … the very thing that puts financial strain on those who can least afford it.

Also think about all those ads you see that promote drugs to reduce rashes, lose weight, increase memory, and cure this or that. Notice that the ad has about 1/3 promises to make your life better followed by 2/3 lists of warnings of side effects, often including the possibility of death! Most of us had no idea that there were drugs for this or that so this must lead to overprescribe medications. My physician friends tell me they are all being pushed to overprescribe.

Clearly this is not good health but smacks of good business, if you measure good by financial returns rather than “do no harm” physicians signed up for.

Our government is banning lots of things these days, so why aren’t they banning salty snacks that lead to serious health concerns?

You rightly snap back at me with the obvious: We have freedom of choice! Or, if you are following the theological implications, use the phrase “free will.” And, I agree, but why do others have the rights to limit my choices then when it comes to heating in my home and what kind of transportation I choose?

And, why are you asking me to pay to help/correct the problems that others have imposed on the food insecure citizens of our country and around the world?

As I have said all along … follow the money.